Retail Bitcoin holdings drop to 17% as wealthier entities dominate

Everyday minnow Bitcoin holders control only a fraction of the top digital asset’s total circulating supply despite its vision of financial decentralization and autonomy.

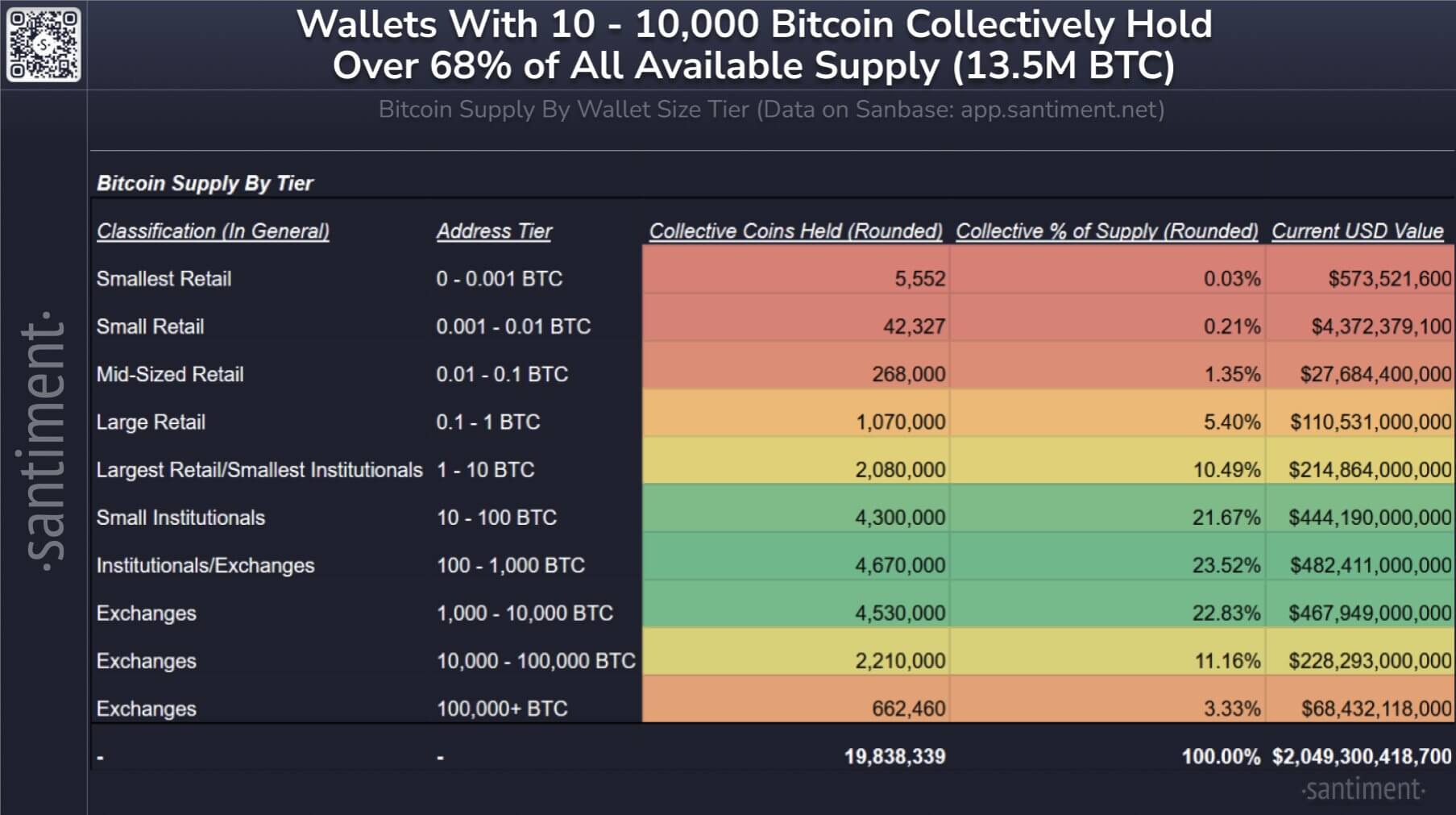

According to a May 14 report from blockchain analytics firm Santiment, retail wallets holding less than 10 BTC collectively own just 3.47 million coins, equivalent to 17.5% of Bitcoin’s circulating supply. This group has approximately $358 billion worth of BTC in dollar terms.

A closer look at the distribution shows an even greater imbalance.

According to the firm, wallets with less than 1 BTC, typically representing smaller retail participants, account for under 7% of the total supply.

Large Bitcoin holders dominate

Meanwhile, Santiment’s analysis points to a strong Bitcoin concentration among wallets between 10 and 10,000 BTC.

According to the firm, this group controls over 68% of the total supply, equivalent to more than 13.5 million BTC. In dollar terms, their holdings are worth $1.39 trillion.

The group includes early adopters, institutional players, high-net-worth individuals, and centralized exchanges.

Within this cohort, wallets holding 100 to 1,000 BTC own around 23.5% of the supply, while those with 1,000 to 10,000 BTC account for an additional 22.8%.

Meanwhile, crypto exchanges like Binance and Coinbase also hold significant BTC. These exchange wallets have more than 7.4 million BTC, making them key drivers of market liquidity and price action.

The post Retail Bitcoin holdings drop to 17% as wealthier entities dominate appeared first on CryptoSlate.

[ad_2]

🔐 Hardware Wallet Tip: Keep your SOL safe with a Ledger Nano X — the wallet trusted by millions of crypto users.